how to decide on term life insurance

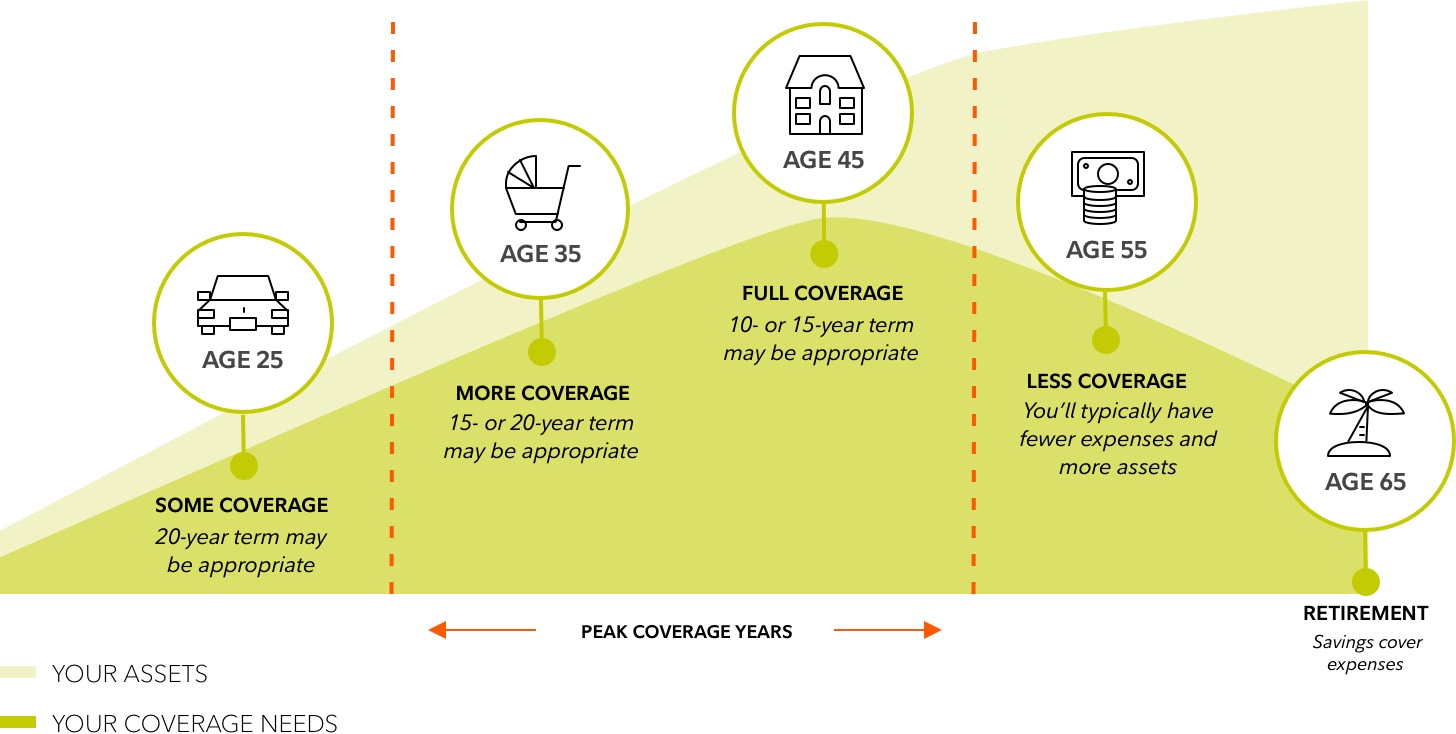

Ad Life Insurance You Can Afford. Term life insurance covers you for a specific period of time say 10 20 or 30 years.

Choosing A Life Insurance Term Length

Carriers Are Ready to Assist.

. Some say multiplying by 5 is enough while the Government of Canada. Ad Find Out How Much Life Insurance Is Right For You. Get Matched With An Advisor Today.

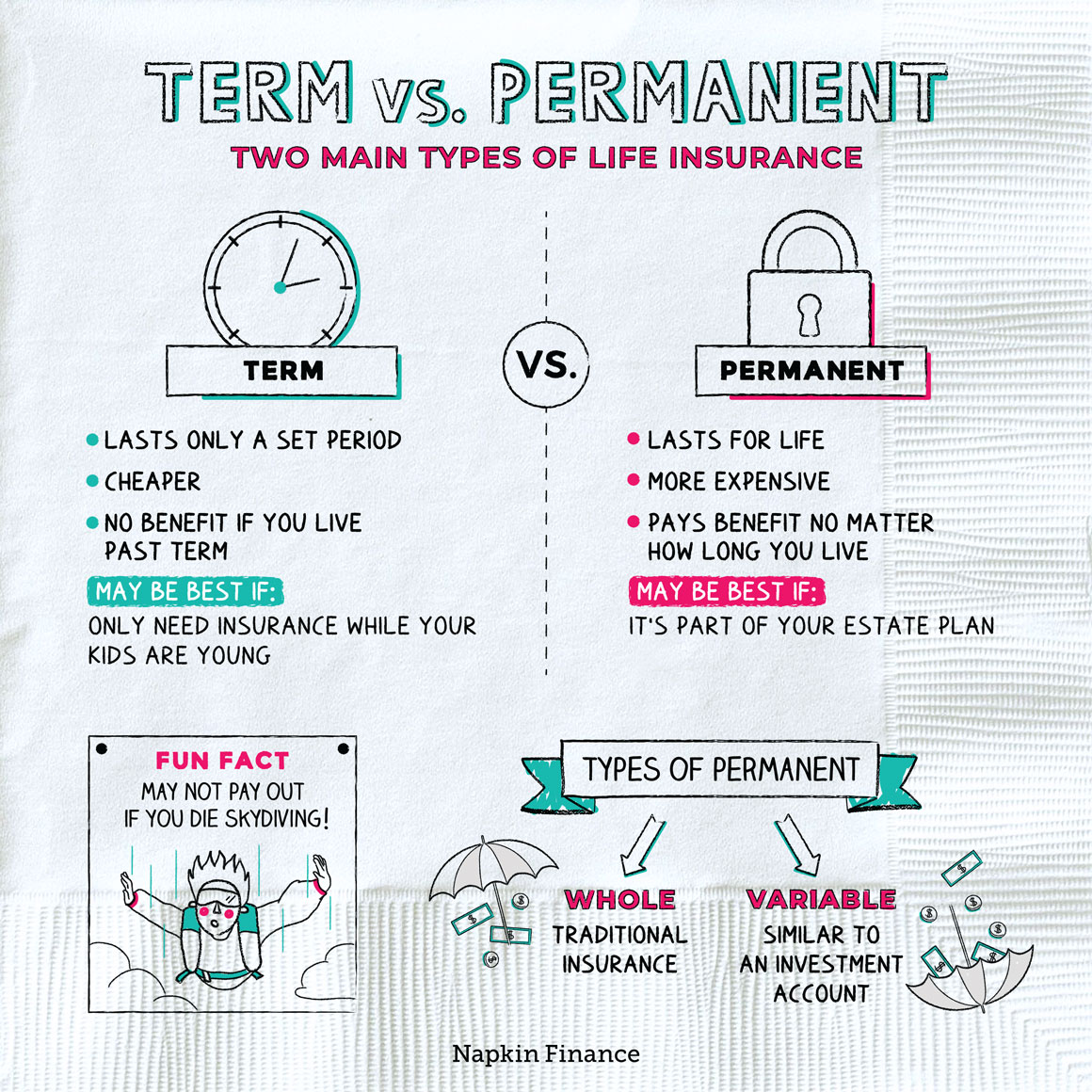

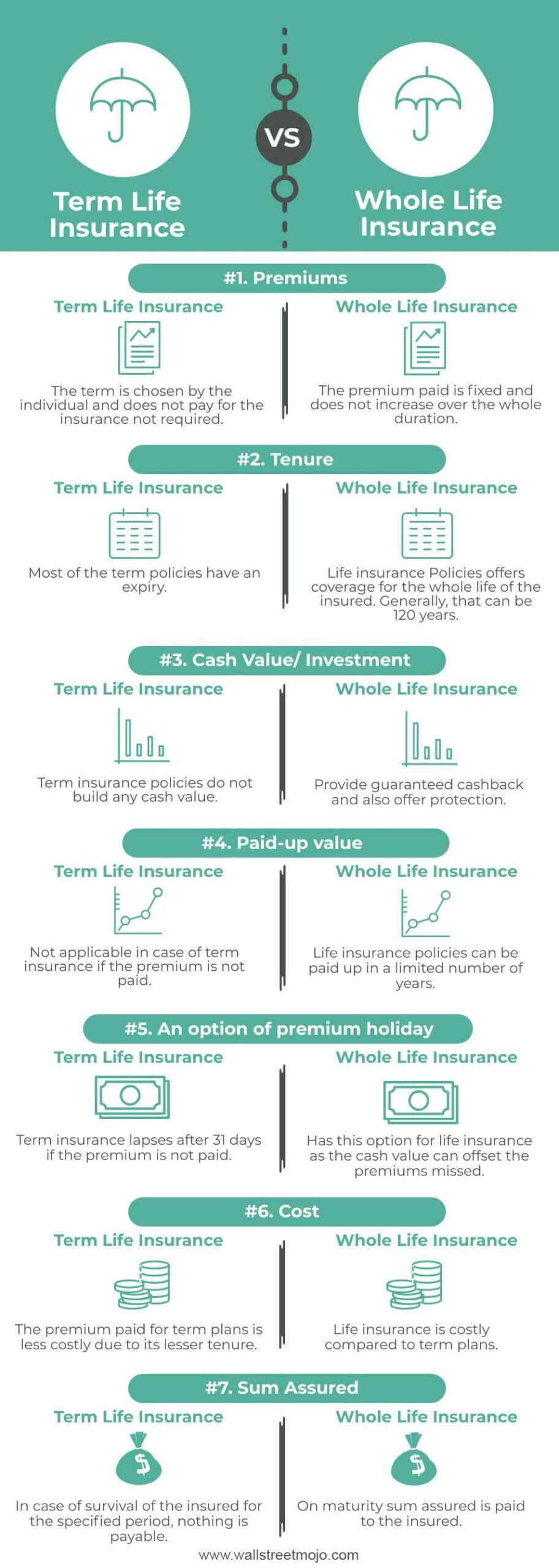

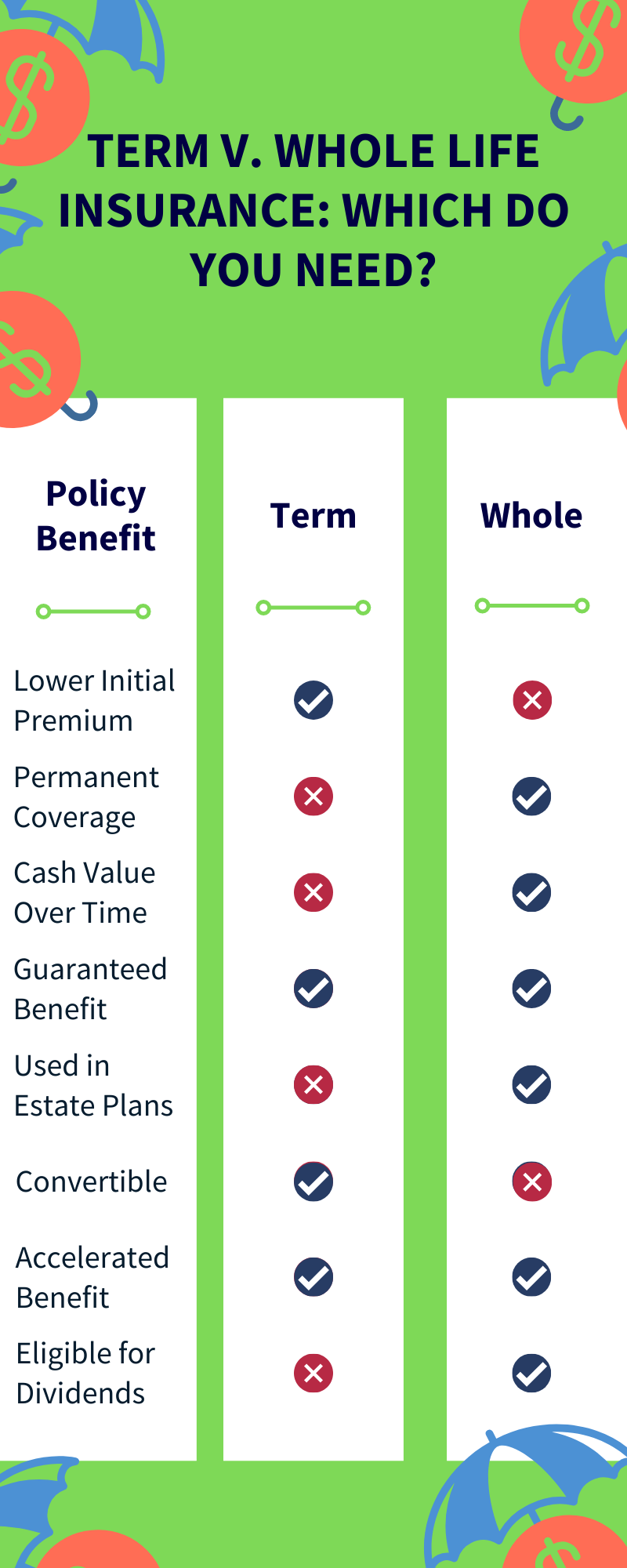

There are 2 main types of life insurance that are considered the most popular. Life insurance can give you. Whole life insurance monthly premiums are higher than term life premiumsfive to fifteen times higher.

Ad No Exam Just Health Other Info. Take for instance the premium rates of iProtect Smart term cover from. Term life insurance pays a benefit if you pass.

Ad Get a Term Life Insurance Policy at a Price You Can Afford. Term 80 Life Insurance Explained. Among the various types of life insurance term life insurance is traditionally viewed as one of the most economical options.

Payout If your premium payments are current your beneficiary is. Ladder offers a unique form of on-demand term life insurance you can adjust as you go. It can vary of course.

8 hours agoThe average cost for a 10-year term life insurance policy is 180 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life. Your premium price for a term life insurance is going to be cheaper than it is for a whole life policy. Buy life insurance as soon as you need it.

Shop Plans From The Nations Top Life Insurance Providers. Your actual premium will be determined by underwriting review. Simply multiply your income by 10 to quickly estimate how much life insurance you should buy.

What You Need to Know. Rates starting at 11month. See How You Can Protect Your Family Your Life With Our Term Life Insurance Policies.

No Medical Exam Needed. Term insurance plans were introduced with a very basic. Easily Find the Most Reliable Affordable Term Life Insurance Providers In One Place.

Your overall life insurance cost will depend on health gender age and lifestyle choices. Term Life Insurance. This blog on how to choose best term insurance plan would definitely help you pick your perfect term plan.

The longer the term obviously the higher. It could be the right call if. Ad Shop Plans From The Nations Top Life Insurance Providers.

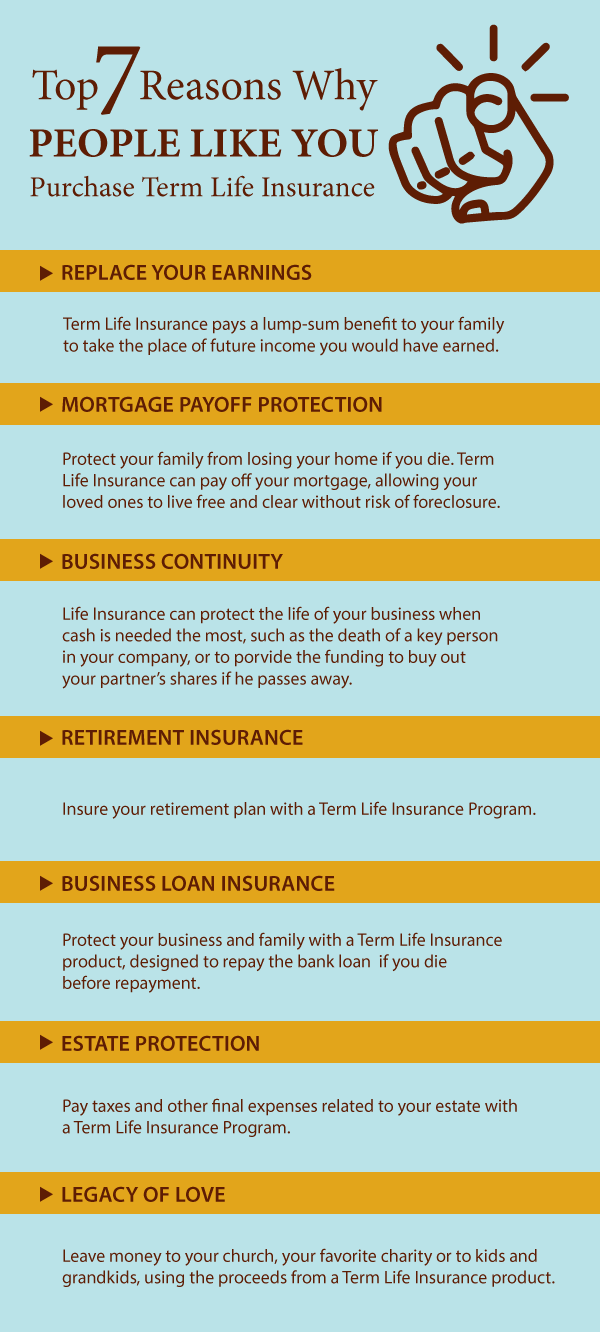

Term life insurance is a simple and affordable way to protect your family. As soon as you know you need life insurance you should buy in order to lock-in lower life insurance premiums. Claim Settlement ratio of a company informs you about the number of policies that are.

September 28 2022 824 AM CBS News. Whole life insurance lasts the insureds whole life while term only lasts. See How You Can Protect Your Family Your Life With Our Term Life Insurance Policies.

Learn how to decide between term and whole life insurance. When looking for a life insurance policy you should know the following facts about term life coverage. Ad Compare the 10 Best Term Life Insurance Providers of 2022.

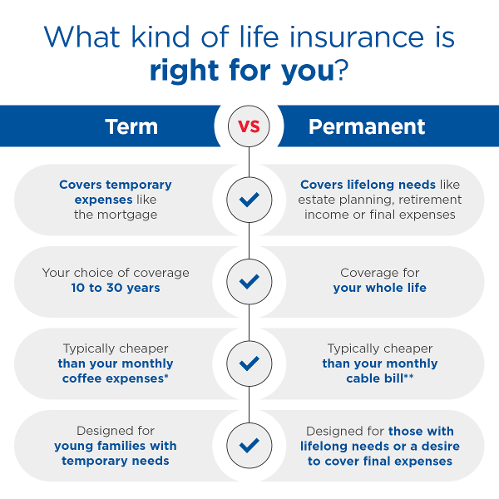

Based on the tenure the insurance company keeps on increasing your term insurance premium. Once the need for life insurance is determined the discussion almost invariably turns to the choice of term life insurance versus whole life or permanent insurance. Acquiring life insurance is an excellent way to prepare for your familys future financial needs.

Ad National Family Saves You Time and Money With Our Intelligent Life Insurance Platform. Ad Apply Online Instantly Receive a Free Quote. Term Life Insurance.

While choosing a term insurance plan one of the major points to consider is Claim settlement ratio. Once the need for life insurance is determined the discussion almost invariably turns to the choice of term life insurance versus whole life or permanent insurance. Alternatively check out our Ladder life insurance review.

On average here is what you can expect to pay per month. Get Your Free Online Quote for 10 20 30 Year Term Whole Life Policies. Compare Plans For Free Online.

Compare Plans For Free Online. A term 80 life insurance policy is pretty. Term and whole life.

You choose the term length and pay the premiums to keep the. Ad Find Out How Much Life Insurance Is Right For You. One should always opt for a policy term depending on their retirement age.

Quick Convenient Online Application Process Makes Getting Term Life Insurance a Breeze. The premium of the policy. Get Matched With An Advisor Today.

No Medical Exam - Simple Application. Quotes reflected are an example from Policy Genius. This may be a good option for you if you cant decide between a whole or term life insurance policy.

Usually most insurance companies offer a policy term between 5 to 40 years.

Term Vs Permanent Life Insurance Aaa Life Insurance Company

What Is Term Life Insurance Experian

The Ultimate Guide To Choosing A Term Life Insurance Policy Csmonitor Com

How To Choose The Right Type Of Life Insurance Iii

Top Pro Tips To Getting The Best 30 Year Term Life Insurance Program

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Explaining The Different Life Insurance Products Aig Direct

Term Life Insurance Everything You Need To Know 2022

Term Vs Permanent Life Insurance Napkin Finance

Term Life Insurance Vs Permanent Life Insurance Cb Acker Associates

What Type Of Life Insurance Policy Do I Need

Term Life Insurance Financial Resources Coverage Options Fidelity

Permanent Vs Term Life Insurance What S The Difference

Decreasing Term Life Insurance Life Insurance Glossary Definition Sproutt

Term Life Insurance Insurance Pro Florida

Term Life Vs Whole Life Insurance Which Is Best For You Credit Com

Term Life Vs Whole Life Insurance Which Insurance Is Better

Term Vs Whole Life Insurance How To Know Which One You Need Gobankingrates