ny paid family leave tax deduction

As of January 1 2018 the 0126 rate will be automatically deducted for all eligible employees. This amount is subject to contributions up to the annual wage base.

New York Paid Family Leave Resource Guide

Paid Family Leave provides eligible employees job-protected paid time off to.

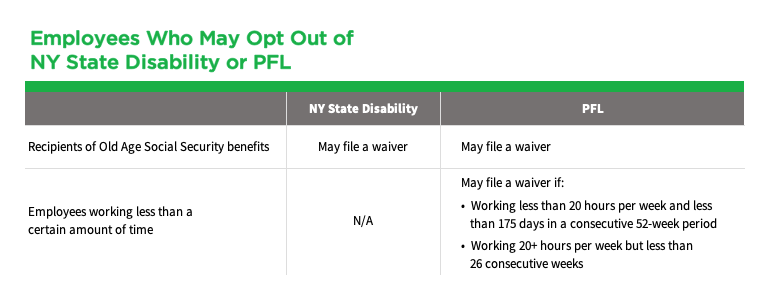

. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. Paid Family Leave PFL is now available to eligible employees of the City of New York. Deductions for the period of time I was covered by this waiver and this period of time counts towards my eligibility for paid family leave.

Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. How the NYPFL Tax deduction works. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Your employer will not automatically withhold taxes from these benefits. You can recoup the PFL portion gradually through payroll deduction over the course of the year. Go to Employees and select Employee Center.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. 2021 Paid Family Leave Payroll Deduction Calculator. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income.

Youll find answers to your top taxation questions below. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax Reference link.

After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employees. Paid Family Leave has tax implications for New York employees employers and insurance carriers including self-insured employers employer plans approved third-party insurers and the State Insurance Fund.

The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

Say Thanks by clicking the thumb icon in a post. Tax Implications of PFL. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

Paid Family Leave may also be available. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. The Department explains the steep increase in the 2021 payroll deduction rate is due to the PFL benefits increasing to 12 weeks of leave at 67 of pay the high utilization of the benefit and the rise in the cost of coverage.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Employees earning less than the current Statewide Average Weekly Wage SAWW of. I certify to the best of my knowledge the foregoing statements are complete and true.

The maximum annual contribution for 2022 is 42371. In 2022 these deductions are capped at the annual maximum of 42371. This means that the updated maximum contribution will be 42371 per employee for 2022 up from 38534.

New York Paid Family Leave employer questions answered. Use of NY Family Leave. The goal amount depends on the number of weeks left in 2017.

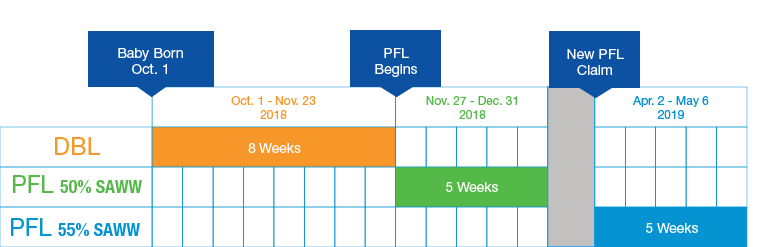

How Does PFL Interact With The Disability Benefits Law DBL. Theres no catch up. Use the calculator below to view an estimate of your deduction.

The New York Department of Financial Services announced. 2022 Paid Family Leave Payroll Deduction Calculator. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period.

Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported. CITY STATE and. These benefits must be secured through a carrier licensed to write New York State statutory disability.

Most employees who work in new york state for private employers are eligible to take paid. In 2021 these deductions are capped at the annual maximum of 38534. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. The maximum weekly benefit for 2022 is 106836. Use the calculator below to view an estimate of your deduction.

Paid Family Leave Benefits available to employees as of. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. An employer may choose to provide enhanced benefits such as.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017. New York paid family leave benefits are taxable contributions must be made on after-tax basis. Increased monetary pay out a shorter waiting period duration to collect benefits or a longer duration for benefits to be paid.

New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. Employers may collect the cost of Paid Family Leave through payroll deductions. EMPLOYERS LEGAL NAME INCLUDING DBAAKATA 2.

Beginning January 1 2018 employees may use paid family leave. The premiums will be post-tax which means deducted from an employees after-tax wages. The maximum contribution is 19672 per employee per year.

The contribution remains at just over half of one percent of an employees gross wages each pay period. Enhanced Disability and Paid Family Leave Benefits. Somers NY group insurance agency.

Use the calculator below to view an estimate of your deduction. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

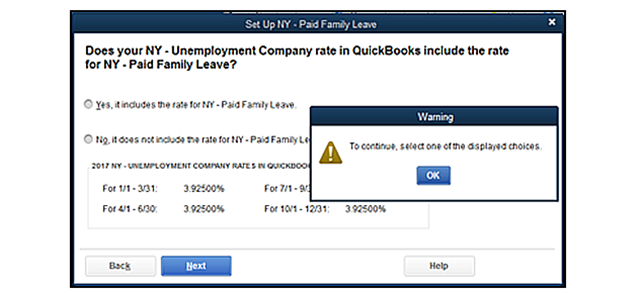

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

New York State Paid Family Leave Cornell University Division Of Human Resources

New York Paid Family Leave Resource Guide

Cost And Deductions Paid Family Leave

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

New York Paid Family Leave What You Need To Know For 2019

Get Ready For New York Paid Family Leave In 2020 Sequoia

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

New York Paid Family Leave What You Need To Know For 2019

Cost And Deductions Paid Family Leave

Nys Paid Sick Leave Vs Nys Paid Family Leave

Get Ready For New York Paid Family Leave In 2021 Sequoia

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released